Inheritance of property can come with implications for capital gains tax, especially when held in a trust. Understanding how capital gains tax applies to inherited property in a trust is crucial for effective estate planning and tax management. To learn more about how to avoid capital gains tax on inherited property, check out Avoid Capital Gains Tax on Inherited Property.

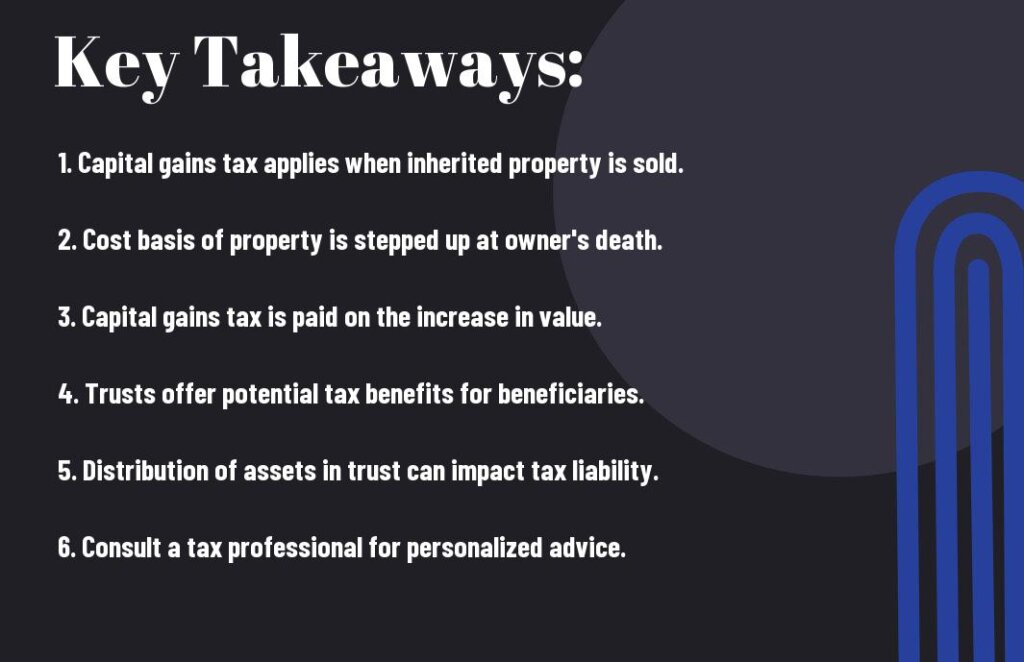

Key Takeaways:

- Capital Gains Tax Impact: Inherited property in a trust is subject to capital gains tax based on the property’s value at the time of the original owner’s death.

- Step-Up in Basis: The beneficiary of the inherited property usually receives a step-up in basis, which is determined by the property’s value at the time of the original owner’s death, potentially reducing the capital gains tax liability.

- Consult with Professionals: It is advisable to consult with tax professionals or estate planning attorneys to understand the specific implications of inheriting property in a trust and to navigate the capital gains tax aspects efficiently.

Understanding Inherited Property in a Trust

Definition of a Trust and Its Purpose

A trust is a legal arrangement where a trustee holds assets on behalf of beneficiaries. Its purpose is to manage and protect assets for the beneficiaries, ensuring they are distributed according to the terms set out in the trust document.

Types of Trusts Commonly Used for Property

There are several types of trusts commonly used for property, including revocable trusts, irrevocable trusts, living trusts, testamentary trusts, and special needs trusts. Each type has its own set of rules and benefits, depending on the specific needs of the grantor and beneficiaries.

| Revocable Trusts | Can be changed or revoked by the grantor during their lifetime |

| Irrevocable Trusts | Cannot be altered or revoked once established, providing asset protection and tax benefits |

| Living Trusts | Created during the grantor’s lifetime and can be used to avoid probate |

| Testamentary Trusts | Established through a will and become active after the grantor’s death |

| Special Needs Trusts | Designed to provide for individuals with disabilities without affecting their eligibility for government benefits |

Trusts offer a flexible and effective way to manage and distribute assets, providing peace of mind for grantors and ensuring the smooth transfer of wealth to beneficiaries. It is crucial to choose the right type of trust based on individual circumstances and goals.

Other Articles You Might Enjoy:

- How to Sell a Probate House in Texas in 2025

- How to Price Your Inherited Home in Houston: A Complete Guide

- Did You Inherit a House with a Mortgage? Learn Your Options

- Inheriting A Property in Texas: Laws, Probate & Options

- 5 Essential Steps to Sell Your Inherited Manufactured Home in Texas

Capital Gains Tax Basics

Definition of Capital Gains Tax

To understand capital gains tax, it’s important to know that it is a tax imposed on the profit realized from the sale of a non-inventory asset. This tax is levied on the difference between the purchase price of the asset and the selling price.

How Capital Gains Tax Applies to Inherited Assets

Capital gains tax on inherited assets is calculated based on the value of the asset at the time of the original owner’s death. When the asset is eventually sold, the capital gains tax is applied to the difference between the sales price and the value at the time of inheritance.

Gains on inherited assets can be subject to capital gains tax, even when held in a trust. It’s crucial to understand the tax implications and seek advice from a financial advisor or tax professional when dealing with inherited property in a trust.

Tax Implications for Inherited Property in a Trust

Step-Up in Basis Rule

One important aspect to consider when inheriting property in a trust is the Step-Up in Basis rule. This rule allows the beneficiary to adjust the value of the inherited property to its current market value at the time of the original owner’s death. By doing so, the beneficiary can minimize capital gains taxes when selling the property in the future.

Exceptions and Special Considerations

Considerations may arise when dealing with exceptions and special circumstances regarding inherited property in a trust. It’s crucial to consult with a tax professional to understand any potential tax implications, especially if the property has increased significantly in value since acquisition.

Understanding the specific rules and exceptions related to capital gains tax on inherited property in a trust is vital for making informed decisions about managing and transferring assets within the trust. Seeking guidance from a tax advisor can help navigate the complexities of tax laws and optimize the financial benefits of inheriting property.

Why Sell Your House To TX Cash Home Buyers?

1. You Pay Zero Fees

2. Close Quickly or the date of your choice

3. Guaranteed Offer

4. No repairs required, we buy as is

5. Less Hassles!

Call Now (281) 595-7550 Send Text

Strategies for Minimizing Capital Gains Tax

Timing of Asset Distribution

With careful planning, distributing assets from an inherited trust strategically can help minimize capital gains tax. By considering the tax implications of when and how assets are distributed, beneficiaries can potentially reduce their tax burden.

Considerations for Selling vs. Holding Inherited Property

Inherited property can present a unique set of considerations for beneficiaries. Each option, be it selling or holding the property, comes with its own tax implications. It is crucial to evaluate factors like market conditions, potential for appreciation, and individual tax situations before making a decision.

Considerations for Selling vs. Holding Inherited Property should also take into account the potential emotional attachment to the property, as well as the overall investment strategy of the trust. Consulting with a financial advisor or tax professional can provide valuable guidance in making an informed decision that aligns with the beneficiaries’ financial goals.

FAQ

Q: What happens to capital gains tax on inherited property in a trust?

A: When a property is inherited through a trust, the capital gains tax implications can vary. In many cases, the cost basis of the property is “stepped up” to its current market value at the time of the original owner’s death, which can reduce or eliminate capital gains tax liability when the property is sold.

Q: How is the cost basis determined for inherited property in a trust?

A: The cost basis of inherited property in a trust is typically “stepped up” to the fair market value of the property at the time of the original owner’s death. This means that the heirs’ cost basis for capital gains tax purposes is the value of the property at the time of inheritance, rather than the original purchase price.

Q: Are there any circumstances where capital gains tax may still be owed on inherited property in a trust?

A: While the step-up in basis for inherited property in a trust is common, there are certain circumstances where capital gains tax may still be owed. For example, if the property is sold shortly after inheritance and has not appreciated significantly, there may still be capital gains tax liability based on the original cost basis.

Q: Can a trust help reduce capital gains tax on inherited property?

A: Yes, a trust can help reduce capital gains tax on inherited property by allowing for strategic estate planning. By utilizing trusts, individuals can ensure that their heirs receive the benefits of a stepped-up cost basis, potentially minimizing capital gains tax liability when the property is eventually sold.

Q: What should individuals consider when planning for the transfer of inherited property in a trust?

A: When planning for the transfer of inherited property in a trust, individuals should consider consulting with a tax professional or estate planner to understand the potential tax implications. It’s important to review the specific details of the trust and the property involved to determine the most tax-efficient strategies for transferring ownership and minimizing tax liability for heirs.

Disclaimer:

The content provided on this blog is for informational purposes only. We are not attorneys or tax professionals. For personalized legal or tax advice, please consult with a qualified professional.

Written by Lisa Martinez, Founder of TX Cash Home Buyers

About The Company

TX Cash Home Buyers helps Texas homeowners sell quickly and simply — even in tough situations like repairs, inherited homes, or financial stress. Founded by Lisa Martinez, we’re known for our local experience, fair offers, and commitment to guiding sellers through off-market sales with clarity and care.